According to ATTOM’s recently released Q1 2024 U.S. Home Sales Report, profit margins on median-priced single-family home and condo sales in the U.S. decreased to 55.3 percent in the first quarter – the lowest level observed in over 2 years.

ATTOM’s latest home sales analysis reported that the decrease in average profit margins, declining from 57.1 percent in the fourth quarter of 2023 and from 56.5 percent a year ago, coincided with a quarterly 4.3 percent drop in the median nationwide home price, down to $330,000.

The report noted that although prices typically retreat during the slower Winter home-selling season, the recent decline represents one of the most significant quarterly drops in the past decade. Concurrently, investment returns for sellers have decreased for the second consecutive quarter following several rises last year, reaching their lowest point since mid-2021.

Also according to the report, despite the decline in seller returns, they continued to outperform most of the housing market boom observed over the past decade. This trend persisted in the early months of 2024, evidenced by the typical gross profit of $120,500 on home sales nationwide.

ATTOM’s Q1 2024 home sales analysis reported that typical profit margins – the percent difference between median purchase and resale prices – declined from the fourth quarter of 2023 to the first quarter of 2024 in 89 out of 134 metropolitan statistical areas across the U.S., accounting for 66 percent of the total. Additionally, they experienced an annual decrease in 71, or 53 percent, of those metros.

The first-quarter sales report recently released by ATTOM also stated that typical profit margins increased annually in 63 of the 134 metro areas analyzed (47 percent). The biggest annual increases in typical profit margins – among metro areas with sufficient population data and at least 1,000 single-family home and condo sales in Q1 2024 – came in the metro areas of: Peoria, IL (margin up from 32.6 percent in the first quarter of 2023 to 52.8 percent in the first quarter of 2024); Scranton, PA (up from 88.1 percent to 106.5 percent); Oxnard, CA (up from 55.1 percent to 71.2 percent); Rochester, NY (up from 50.4 percent to 65.2 percent) and San Jose, CA (up from 85.8 percent to 100 percent).

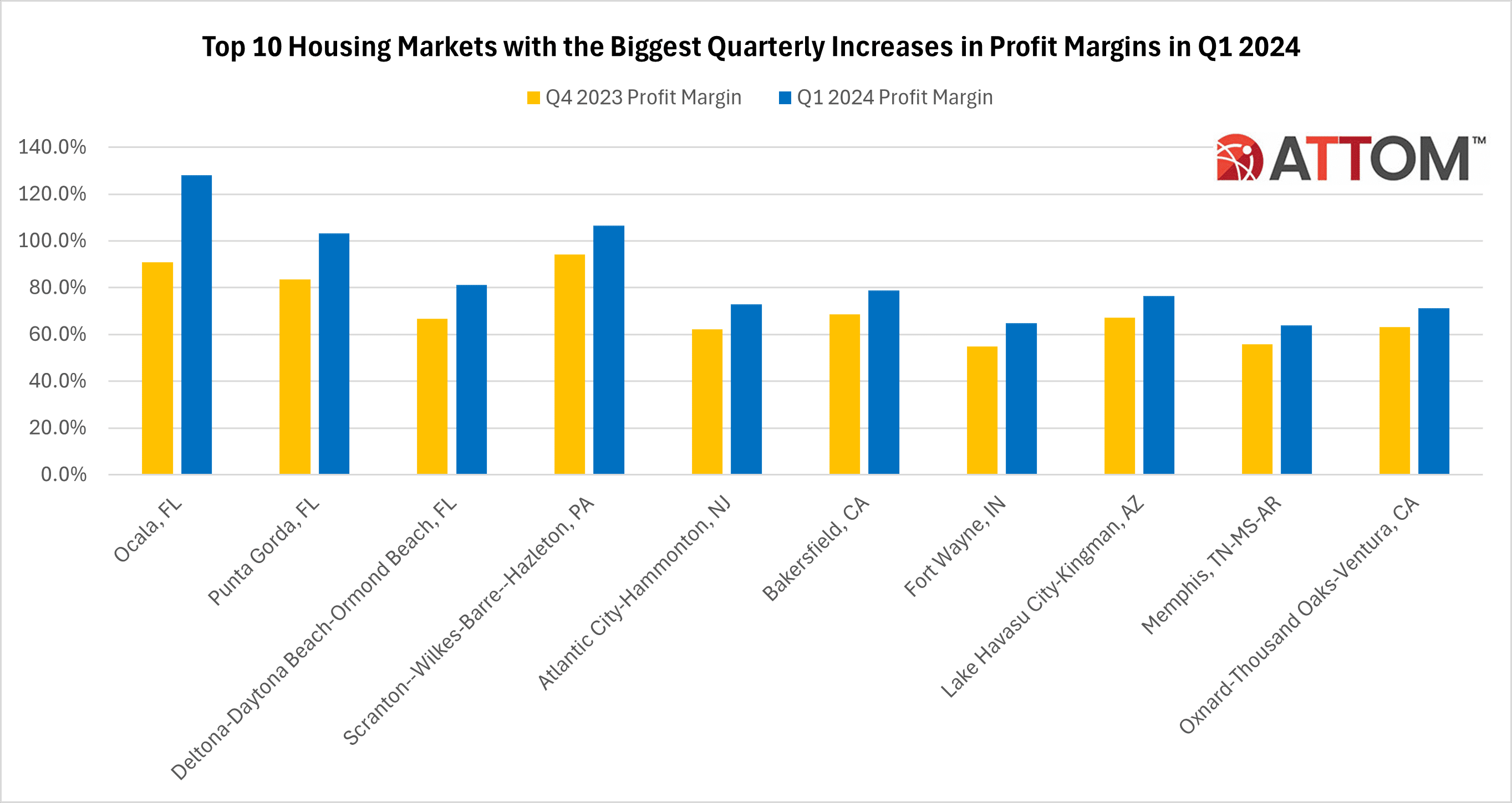

In this post, we dive deep in the data behind ATTOM’s Q1 2024 home sales report to uncover the complete list of the top 10 U.S. metros with the biggest quarterly increases in home seller profit margins in Q1 2024. Those metros rounding out the top 10 include: Ocala, FL (up from 90.8 percent to 128 percent); Punta Gorda, FL (up from 83.5 percent to 103.1 percent); Deltona–Dayton Beach-Ormond Beach, FL (up from 66.7 percent to 81.1 percent); Scranton–Wilkes Barre–Hazelton, PA (up from 94.1 percent to 106.5 percent); Atlantic City–Hammonton, NJ (up from 62.1 percent to 72.8 percent); Bakersfield, CA (up from 68.7% to 78.7%); Fort Wayne, IN (up from 54.7% to 64.7%); Lake Havasu City-Kingman, AZ (up from 67.1 percent to 76.3 percent); Memphis, TN-MS-AR (up from 55.7% to 63.9%); and Oxnard-Thousand Oaks-Ventura, CA (up from 63.1% to 71.2%).

Want to learn more about home sale trends in your market? Contact us to find out how!

About The Author

Read More: Top 10 Housing Markets with Biggest Quarterly Increases in Profit Margins in Q1 2024